Remote Deposit Capture (RDC) FAQ Sheet

How do I sign up for Remote Deposit Capture?

Enrollment is not required. Qualified accounts will be able to access within the mobile app.

My account does not qualify. What are the requirements?

To qualify for RDC, the account must be in good standing, opened for 30 days and the primary account owner must at least be 18 years old.

Is there a fee?

No, RDC is a free feature within the Encompass Mobile App.

What are the maximum deposit limits?

Per Item: $5,000

Daily:$5,000

Monthly: $15,000

Is there a minimum deposit limit?

No.

When will my funds be available? How long is my money on hold?

Daily, the first $275 deposited will be made available immediately. A two-business day hold is applied to the amount over $275.

What is a pending deposit?

You may receive a pending deposit message if the app detects a possible error in the endorsement of the check. These checks will be reviewed and accepted if possible or you will be contacted as stated below in the “Will I get a notification if my check is rejected after acceptance within the app?”

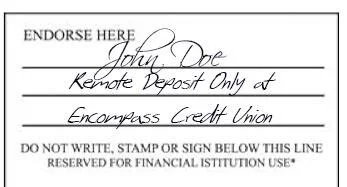

How do I endorse the back of the check?

Below your normal endorsement, print “Remote Deposit only at Encompass Credit Union.”

I am having a problem with the App accepting my check, what can I do?

When taking the picture of your check, make sure that your camera lens is clean, you are close to the check when taking the picture, the background is one plain color and nothing should be in the picture but your check.

What do I do if I endorsed my check for RDC but it was not accepted?

Check will need to be brought into branch for further review, but likely will not be able to be deposited at any other financial institution due to the restrictive endorsement.

Can I deposit a foreign check?

No, only United States checks can be processed through RDC, foreign checks can be processed at the branch.

I deposited a check in error, can I delete it?

This depends on the situation. Contact the Credit Union at (800) 675-8852 option 6.